Hello All! Hopes today is a good day again for you! Today I would like to tolk to you about my last activities in SAP regarding Comission vehicle and how we can return or sell it to customer. But before we should take it from him. So it it such process, when we take from customer vehicle on our stock, without paying him money for this vehicle until it will be sold. Only after this we will pay him money for vehicle and take from him some sommission fees, that we done all those activities on salling and advetising and storage his vehicle on our stock ..etc. Here represented a local design made for russia and very popular here.

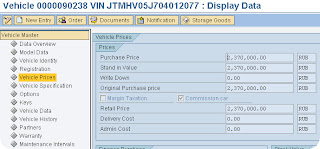

So look. we create normal used vehicle in SAP DBM, but in Vehicle prices tab we should make a tick that this vehicle comission .This tick will influence on our account determanation, so it is very important for us. Then we should input all the prices for vehicle, both purchase and sales price should be equal, because we don't have a MARGIN from this vehicle, we just sell it on customer price.

So look. we create normal used vehicle in SAP DBM, but in Vehicle prices tab we should make a tick that this vehicle comission .This tick will influence on our account determanation, so it is very important for us. Then we should input all the prices for vehicle, both purchase and sales price should be equal, because we don't have a MARGIN from this vehicle, we just sell it on customer price.

Look at picture at the left. It is our vehicle prices tab.

So after this we can do all the activities to purchase vehicle.They will be the same as purchase new vehicle, you can see in my messages earlier. But we must do 2 activities only:-). Creta purchase order on Storage location - Comission stock and Goods reciept, we can't do activity cretae incoming invoice, due to we will pay customer when we will sell this vehicle.

So in the day when Slaes order will be created we can do activitie create incoming invoice to sell vehicle.

Then complite all the requried fields in Order and press Save, then press Create billing and Goods movement.

And in this case we should create debit memo for taking comission from customer.

In case we sell the vehicle during a long period of time, but still can't do it and customer desided to take vehicle back, we should create return order. BUT it will looks the same like sales order in our design, only Flag Comission car return should be YES. In this case all accounting data will change to make return.

In case we sell the vehicle during a long period of time, but still can't do it and customer desided to take vehicle back, we should create return order. BUT it will looks the same like sales order in our design, only Flag Comission car return should be YES. In this case all accounting data will change to make return.

Sales order header will lokks like on picture left.

After Sales header complited you should press Create billing and create goods movement. Then go to FI document and check postings. See the picture below.

Debit memo will have also such flug in Header. You should choose Yes. And input the comission value with VAT.

Then go to items tab and choose "Comission sale", input 1 job and amount of comission without VAT. Double input of VAT influeced SAP rounding system, because russian cents are still important in handrieds after point , and here always SAP makes wrong rounding. Look item tab in picture below.

So that is all for today! Hopes, you were happy to read this postings. Sayy to all "Have a good day! Good luck!"

,

,

,

,

,

,

,

,